Your 2023/24 Union Tax Statement

How to access your Tax Statement (available from July 8th)

IMPORTANT NOTE: Accurate tax statements can only be generated after union dues to June 30 are cleared with members' banks. Tax statements will be emailed to eligible members & will be available for download via Memberlink from July 8 for most members. Some members may experience slight delays. Please see below for more information.

More information:

When will my Statement become available?

Your statement includes all fees paid up to June 30. Banks then need to clear all payments with UWU.

- First week of July, UWU receives confirmation of your last payment from your bank.

- Second week of July, UWU sends a statement to your registered email address *

* Note: If your employer deducts your union fees from your pay, they will provide a statement directly to Australian Tax Office.

It's after July 8 - where is my statement?

If you haven't received your statement by July 8, 2024 - please consult the below:

- Are your union fees deducted by your employer, or paid directly to UWU? If your employer deducts your union fees from your pay, they will provide a statement directly to Australian Tax Office & you will not receive a statement from UWU. You will not need to download a statement to claim your deduction.

- If you pay your union fees directly to UWU via credit card or direct debit, please check your email inbox & junk mail folders. There's a chance the email with your union tax statement may have been sent to your junk mail / spam folder. Please double-check your email address(es) for your tax statement.

- Tax statement should be in your inbox, but you can't find it? There may be a slight delay due to bank processing times. Your union tax statement will appear in your MemberLink portal as soon as it's ready to go. Please register & login here.

- Still can't find your tax statement? Contact us via the details in the "Need Help?" tab below.

Who will receive a Tax Statement from UWU?

All members who pay their union dues by direct debit or credit card will receive a 2023/24 tax statement from UWU.

If your employer deducts your union fees from your pay, they will provide a statement directly to Australian Tax Office. You will not need to download a statement, this amount will be automatically deducted at tax time.

Can I claim my Union Fees as a Tax Deduction?

Your union fees can be claimed as a work-related deduction on your tax return.

The Australian Taxation Office provide full details here: ATO - Other work-related expenses

Note: If your employer deducts your union fees from your pay, they will provide a statement directly to Australian Tax Office.

How do I get a copy of my Union Fees Tax statement?

Wait until the week commencing July 8 – no accurate statement can be provided prior to this date.

After July 8, you will be able to access your tax statement one of two ways:

- Monitor your email inbox(s) including Junk or Spam folders in case your email provider puts the UWU email in one of those folders.

- Login to Memberlink and download your statement - see the bottom of this page for instructions.

Can I download my Tax Statements from previous years?

To download Union Fees Tax Statements from previous financial years, please login to your Memberlink account.

Click here to LOGIN TO Memberlink

1. When you first login to Memberlink:

Once you've logged into Memberlink, click the "Finances" menu item to get to the "My Dues" page:

2. How to download your Tax Statement(s) from the "My Dues" page:

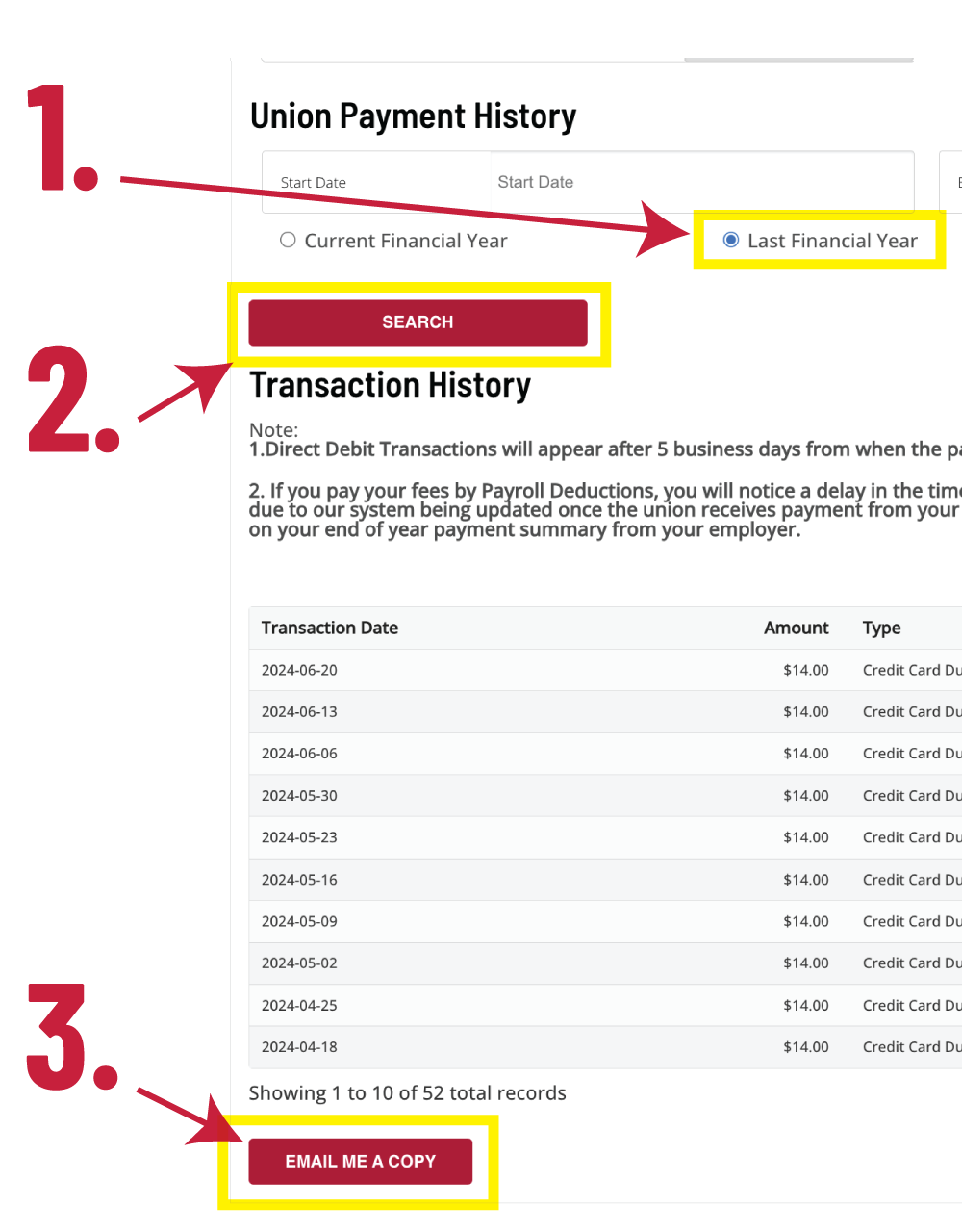

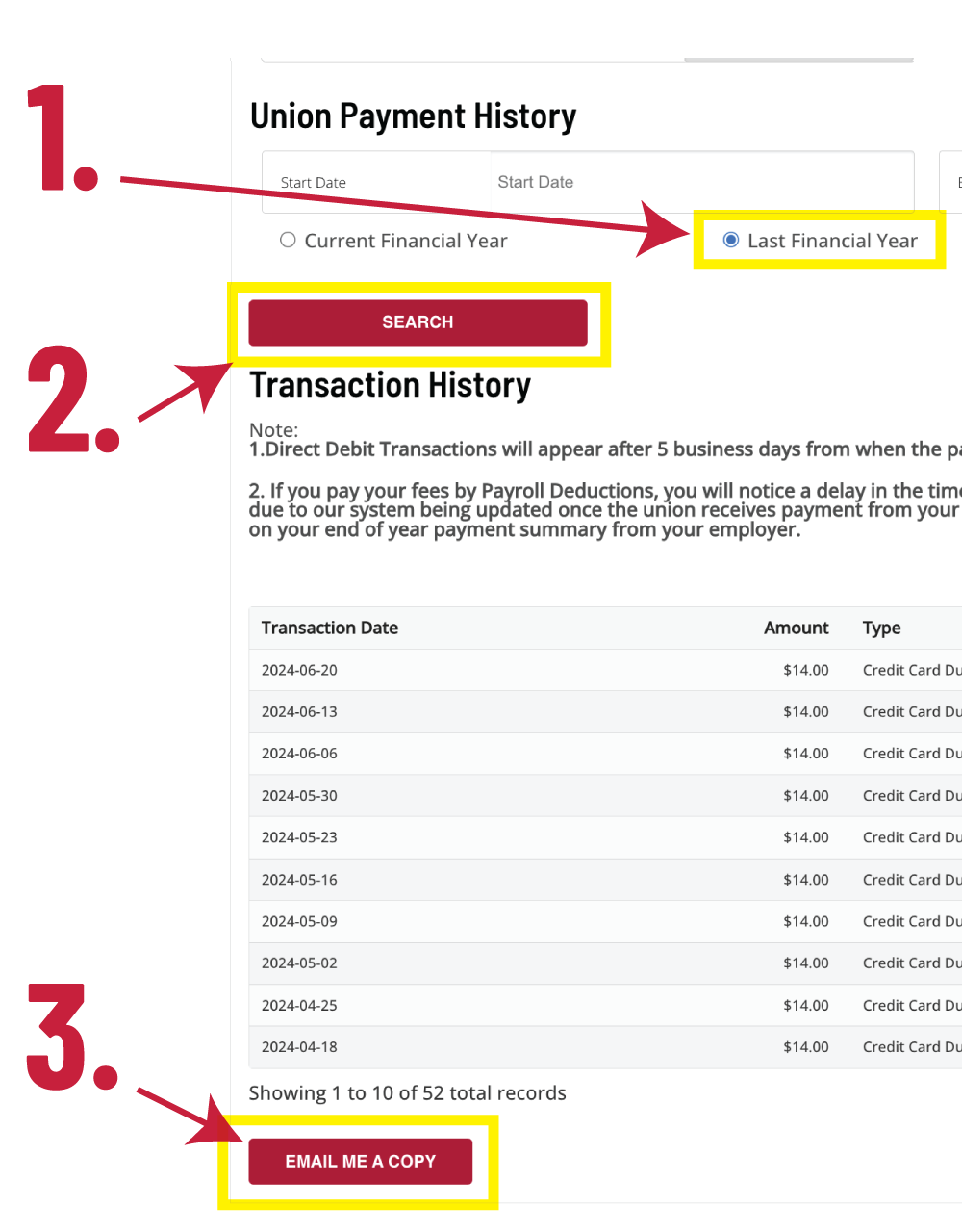

- From the "My Dues" page, scroll down to Union Payment History & select the "Last Financial Year" checkbox (see 1 in the image below). You can also choose custom dates here, if you need statements from other financial years.

- Then hit the "SEARCH" button (see 2 in the image below)

- Then scroll down & click the "EMAIL ME A COPY" button (see 3 in the image below). The portal will then email you a PDF copy.

Need help?

If you need assistance you can contact the UWU Membership Services team by phone or email:

Phone: 02 8204 3001

Email: [email protected]

How to download your tax statement after July 8

After July 8, members who pay their union dues by direct debit or credit card will receive a 2023/24 tax statement from UWU via email (please check your spam & junk folders). Please note: If your employer deducts your union fees from your pay, they will submit this amount to the ATO directly, and you will not need to download a statement.

Members can also download their Union Fees Tax Statement by logging into the Memberlink member portal & following the instructions below.

Instructions for downloading your Tax Statement via the Memberlink portal

Access Memberlink now:

Click here to login / register for Memberlink

Instructions for downloading your statement:

1. When you first login to Memberlink:

Once you've logged into Memberlink, click the "Finances" menu item to get to the "My Dues" page:

2. How to download your Tax Statement(s) from the "My Dues" page:

- From the "My Dues" page, scroll down to Union Payment History & select the "Last Financial Year" checkbox (see 1 in the image below). You can also choose custom dates here, if you need statements from other financial years.

- Then hit the "SEARCH" button (see 2 in the image below)

- Then scroll down & click the "EMAIL ME A COPY" button (see 3 in the image below). The portal will then email you a PDF copy.

Need help setting up your account?

Once you've set up your Memberlink account for the first time, you'll be able to easily login & access your information in future.

If you need assistance setting up your account, you can contact the UWU Membership Services team by phone or email:

Phone: 02 8204 3001

Email: [email protected]